How to Pay Low Fees & Get the Best Service for your Real Estate IRA

Real Estate IRAs are the hottest investment trend for real estate investors. However, some potential investors are put off by the fees and some self-directed IRA providers. Here are 3 factors you should consider when opening a self-directed IRA to invest in real estate: fees, service, and knowledge.

Fees – Don’t Overpay for a Real Estate IRA

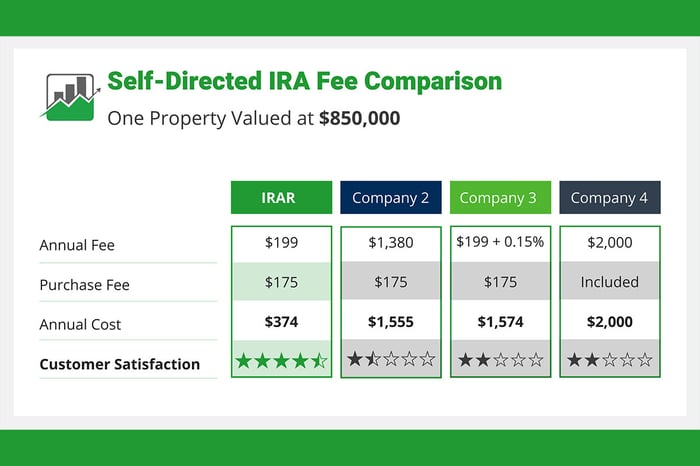

If you don’t do the research and compare providers beforehand, you may overpay or be overpaying for your Real Estate IRA. Real Estate IRAs should not cost you a fortune— after all, with a self-directed IRA, you are the one making the investment decisions. All providers are different and charge in different ways, with some charging based on asset value and others based on number of assets. Get your FREE TEMPLATE to help you assess the fees associated with a self-directed IRA.

When you invest in real estate your IRA will have to pay taxes, insurance, and other types of payments. Asses the annual cost for these transactions while considering your investment strategy. Some IRA providers do not charge a check fee, but be careful— the all-inclusive annual fees can triple the cost of any self-directed IRA.

At IRA Resources, some of our clients schedule these payments quarterly, annually or as allowed by the service provider instead of requesting checks monthly, in order to save on the check fee. We do our best to make our self-directed IRAs as easy and low-cost as possible for our clients, any way we can.

Another way to save money is by using an IRA LLC. If you are planning on purchasing multiple investments in one IRA, you might want to consider an LLC. Research the costs associated with establishing a LLC – this is not something IRA Resources can do for you. Your LLC will hold the real estate, while IRA Resources holds your LLC. If you have an IRA LLC held at IRA Resources, you are billed $99.50 semi-annually, regardless of the number of investments within the LLC itself.

Service – Get More Than What You Expected

Saving on fees is great, but it is just as important to make sure that you are getting excellent client services from a knowledgeable team. Clear communication is very important, especially when it comes to your retirement.

The self-directed IRA industry uses a lot of terminology or jargon. If you inadvertently say something or make a request that is understood as something else, there can be disastrous consequences (like the loss of tax status and/or a hefty fine). Make sure that the person on the other end of the phone line understands exactly what you are trying to accomplish with your transactions. Explain your investment purchase or strategy in detail— do not assume the representative intuitively knows what you want. They should be engaged in the conversation, asking you questions that may lead to discoveries, warnings, or tips.

If you feel like you are being rushed to get off the phone, this is a warning sign of subpar customer service. As a potential client, you should feel appreciated and get more than what you expected— this is an indicator of how current clients are treated by representatives.

Knowledge – Expect More from Our Experts

Asses how well they know Real Estate IRA transactions (the template I mentioned earlier can help you do that). Are they knowledgeable enough to answer your questions? Ask about the options you have to fund your purchase and if all of these are allowed at their establishment. Make sure this information lines up with what you’ve researched and heard from other providers.

What is their turnaround time to review your purchase contract offer? To give you an idea, at IRA Resources we review the purchase contract offer the same day or within 24 hours, because we are focused on the success of our clients’ transactions.

It is important for representatives assisting you to know IRA rules (to make sure you are not making a prohibited transaction) but due to the complexity of the transactions it is just as important for them to have experience in real estate transactions. Are they experienced in working with your real estate agent, attorney, title company, and insurance agent? The real estate IRA process is similar but different from when you or a friend purchase a home. For things to go smoothly during this process, the representatives must know how to answer questions from all parties involved in the transaction. A mistake during this process can drag things out, or even cause a deal to fall through—a nightmare for all involved.

Do not be put off by fees or a lack of knowledge, because not all providers are the same —but do the research beforehand. Your investment strategy and transaction volume should dictate the type of fee structure that is appropriate for you, in order to spend less on fees and save more for retirement.

Give us a call to discuss our fees and service in more detail. Find out how we compare to other providers, you will be pleasantly surprised at what we have to offer.

Self-Directed IRA Cost Comparison

Frequently Asked Questions

What fees should I expect when opening a Real Estate IRA?

Most custodians charge a setup fee, an annual account fee, and a fee for each transaction. Some also charge for incoming or outgoing wires, check payments, or valuing the asset each year. Every provider structures fees differently, which is why comparing the full fee schedule matters before you choose a custodian.

How can I compare fees across different Self-Directed IRA custodians?

Start by looking at how the custodian charges. Some use flat fees. Others use asset-based pricing or charge per asset. Review the setup cost, the annual cost, and the cost to complete common actions like rent payments or expense payments. Using our comparison template can help you see the difference quickly.

Does a lower fee always mean better value?

Not always. A good custodian gives you both fair pricing and reliable service. Look for clear communication, quick processing times, and experience handling real estate transactions. Paying a little less is not worth it if slow service delays your deals or creates avoidable stress.

What questions should I ask before choosing a custodian for my Real Estate IRA?

Ask about their fees, how long transactions take, what support is available for real estate investors, and how they handle urgent items like contract reviews or time-sensitive closings. Also confirm if they have specialists who understand real estate rules and prohibited transactions.

How do expenses get paid from a Real Estate IRA?

All property-related expenses must be paid by the IRA. This can include taxes, insurance, HOA dues, repairs, and maintenance. Each payment will trigger a specific custodian fee. If the property generates frequent expenses or rent payments, choose a custodian with low transaction fees to avoid unnecessary costs.

Can I reduce my IRA fees by changing my payment habits?

Sometimes. If a custodian charges per payment, you may be able to schedule certain recurring items to reduce the number of transactions. For example, making HOA or utility payments quarterly instead of monthly can lower your annual costs. It depends on the fee structure of the provider you choose. Make sure to compare.

What is an IRA LLC and does it affect fees?

An IRA LLC is an LLC owned by your IRA that gives you checkbook control for investment-related spending. This can reduce some transaction fees because payments are made directly from the LLC bank account. Keep in mind that an IRA LLC can add setup and maintenance costs and requires careful compliance.

Are there fees when I sell a property inside my Real Estate IRA?

Most custodians charge a fee to process the sale paperwork. This can include contract review, signature processing, and handling incoming funds. Every provider is different, so review and compare the fee schedule in advance to avoid surprises when it is time to sell.

Comments (1)