Fair Market Value

Has the value of your assets been updated? Here is more information on what you need to submit.

Updating The Fair Market Value (FMV) Of Assets In An IRA

Annual Statements

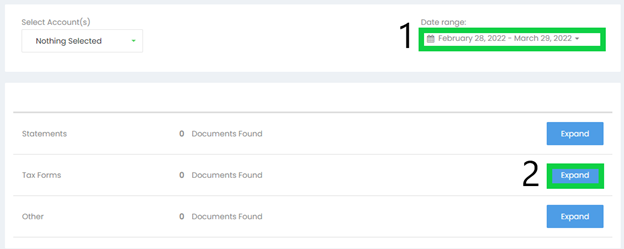

Year End Statements and Tax Forms Are Available Online.

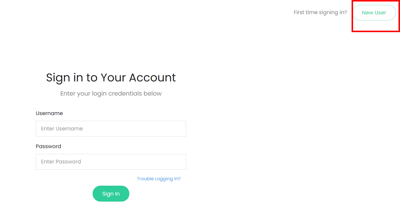

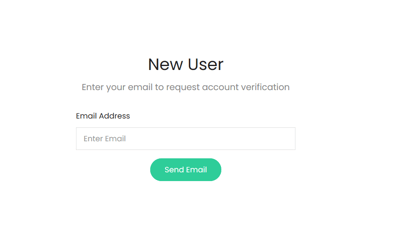

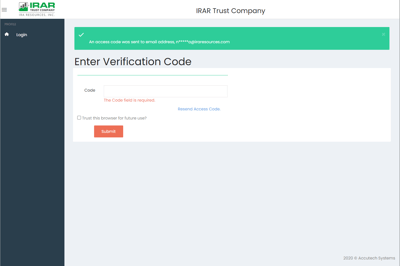

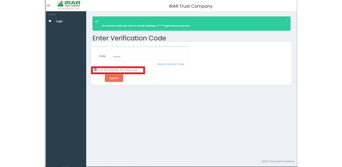

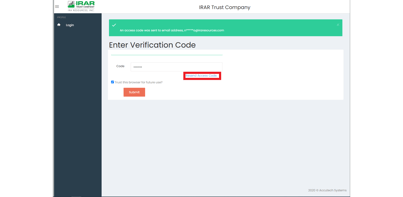

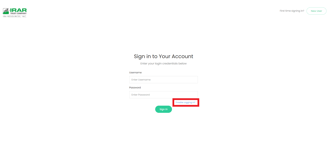

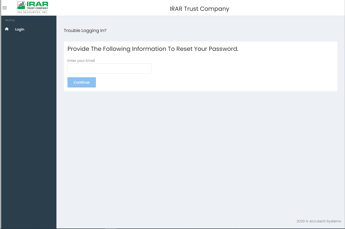

You can access statements and tax forms from your portal. Login to download. If you have not established a profile, sign up now..

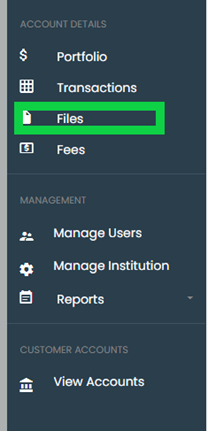

You MUST use the email address that you provided on your new account application. After logging in, navigate to "Files" tab on the sidebar.

Update Your Personal Information

Have you moved or changed your contact information? Please update us: Change of Address Form

Review Your Beneficiaries

If you don’t have this properly set-up (or worse, have the wrong person listed) your IRA could end up in probate or going to a different person than you planned. To add or change the beneficiaries for your account use this form: Beneficiary Designation

Updated Fee Schedule

We're making a few small changes that may or may not affect your account.

The great news is that the current annual administration fee disclosed in 2017 remains the same. Be sure to check out our updated fee schedule to learn more! Download a copy for your records.

Check Before You Invest

Check Before You Invest is an investor education awareness campaign created by the Retirement Industry Trust Association, a trade association for self-directed IRA providers.

The purpose of this initiative is to promote investor awareness through educational materials and resources provided by state, federal, and private agencies. Here is a handy checklist.

Privacy Policy

How We Protect Your Privacy

At IRAR Trust, it is important to us that we maintain your trust and confidence when handling your personal information. Its security is our utmost priority. We protect this information by maintaining policies and procedures that safeguard your information. We train our employees in the proper handling of personal information. This notice applies only to non-public personal information.

Our Privacy Policy.

IRAR Trust recognizes that protecting the privacy of non-public personal information is of utmost importance.

To meet this goal, we strive to institute and maintain appropriate safeguards and standards as required by the Graham-Leach-Bliley Act (GLBA) for the administration, technical protection, and security of customer data. This policy establishes IRAR Trust’s privacy objectives and guidelines to ensure that recordkeeping activities regarding protecting consumer data are conducted in a controlled and successful manner. We value our client relationships and we want you to understand the protections we provide regarding your accounts with us.

Information We May Collect.

- As Custodian for your account, we collect, retain, and use non-public personal information about you from the following sources in order to conduct business with you:

Information we receive from you on applications or other forms;

- Information about your transactions with us, or others;

- Non-public personal information includes, but is not limited to: social security numbers, credit card information, information about account balances, and account history.

Information We May Share.

We do not sell or disclose any non-public information about you to anyone, except as permitted by law or as specifically authorized by you. We do not share non-public personal information with other providers without your prior authorization. Federal law allows us to share information with providers that process and service your accounts. All providers of services in connection with IRAR Trust have agreed to our confidentiality and security policies. If you decide to close your account(s) or become an inactive client, we will adhere to the privacy policies and practices as described in this notice.

Confidentiality and Security.

We restrict access to non-public personal information to those employees who need to know that information to provide products and services to you. We maintain physical, electronic, and procedural guidelines that comply with federal standards to guard your non-public personal information. IRAR Trust reserves the right to revise this notice and will notify you of any changes in advance.

We appreciate the opportunity to serve your retirement needs. We recognize the importance of protecting your non-

public information. We are committed to following the policies and safeguards as outlined and described in this notice.

Thank you for choosing IRAR Trust Company.

Download a copy of our Privacy Policy