Roth IRA: Everything You Need to Know to Open an Account

When the IRA was first created, you only had one option. But since 1997, a new option emerged, and it's become increasingly popular: the Roth IRA! This account allows for self-direction, letting you invest in assets beyond what traditional brokerages offer, like real estate.

This favorite among self-directed investors helps retirement savings go the distance. Curious how a Roth IRA works? We'll break down the key benefits for below.

How Roth IRAs Work

If you’ve ever contributed to a Traditional IRA or 401(k), you’re probably used to tax-deferred contributions (cash savings or deposit from earned income) being “pre-tax”. This means they’re not taxed when initially deposited into your retirement account, and these contributions may be tax-deductible.

The biggest difference between a Roth IRA and a traditional IRA is the tax benefits. Most notably, contributions are handled differently. With a Roth IRA, contributions are “post-tax”. This means you pay taxes on these funds before you contribute them to your IRA (like normal income), and there’s no tax write-off.

Although you don't get a tax break, or lower your taxable income, investors like this option because of the long-term benefits. Yes, you can currently deduct contributions from a Traditional IRA and 401(k), but taxes will be due when you make withdrawals. However, with a Roth IRA, you pay zero taxes on funds withdrawn during retirement.

Roth IRA Eligibility

To contribute to a self-directed Roth IRA, you (or your spouse, if filing jointly) need to have earned income equal to your contributions for that year. If your earned income was $2,000, you can’t contribute $6,000 to your IRA (unless, as stated previously, your spouse has earned income and you are filing jointly).

Self-directed Roth IRAs also have a maximum income to be able to contribute, Modified Adjusted Gross Income (MAGI). See table below.

If you (or you and your spouse) make more than the stated income limits and have a Roth IRA, you can still invest those Roth funds, but you won’t be allowed to contribute new savings to a Roth account. That is because these accounts (and their specific sort of tax benefits) are meant to target lower-income and beginner investments, and this promotes Traditional IRA for high earners once they hit the threshold. They’re tax-advantaged accounts with specific eligibility requirements.

2025 and 2026 Modified Adjusted Gross Income Limits for Roth Contributions

If you don’t have earned income or make more than the Roth IRA income limits, unfortunately, you aren’t eligible for a Roth account. However, there is another way to get funds into a Roth— through a Roth Conversion.

Roth Conversions

There are income restrictions on contributions to a Roth IRA, but if you exceed these limits, you may have the option to convert your funds from a Traditional IRA.

Often referred to as a “backdoor Roth IRA”, a Roth Conversion lets you move your existing retirement savings to a Roth IRA. There’s no IRA income limit and no early withdrawal penalty, but you‘ll have to pay regular taxes on the funds you are converting (as if you initially contributed to the Roth IRA). Afterward, the funds can be treated like any other Roth IRA funds, with the same rules.

Roth IRA Contribution Limits 2024

For 2024, the maximum contribution limit for individuals under 50 is $7,000 annually, with those age 50 and older eligible for an additional $1,000 catch-up contribution, bringing their total limit to $8,000. These limits ensure equitable contributions across different income levels and stages of life.

Distribute Contributions Any Time, Tax-Free

Another advantage investors often appreciate, initial contributions can be distributed penalty-free, no matter your age or reason. So, say you contribute $5,000 to your Roth IRA. When you need it, you can withdraw that initial $5,000 penalty-free. You can’t withdraw any of the gains from investments (so if your $5,000 doubled and is now $10,000, you can still only distribute the original $5,000 without penalty).

Though it’s always best to leave retirement funds in their tax-advantaged state (growing bigger for your future), it’s nice to have this option if an emergency should arise.

No Required Minimum Distributions (RMD) for Roth IRAs

Since you’ve already paid taxes on your contribution, the IRS doesn’t need you to take Required Minimum Distributions (RMDs) like with Traditional IRAs. If you want, you never have to withdraw funds from your Roth IRA— they can stay in your IRA indefinitely.

With accounts such as a Traditional IRA or 401(k), you're liable for taxes on any withdrawal from the IRA, treating it as ordinary income, even if you wait until you're 59 ½ to do so.

In fact, starting at age 73, you're obligated to begin taking distributions (required minimum distributions) from a Traditional IRA and pay taxes on those amounts— otherwise, you risk severe penalties.

A Roth IRA completely eliminates this issue. Your retirement funds are entirely at your disposal, to be used at your discretion, with no further taxes due after you reach 59 ½ years old, provided your Roth IRA has been active for a minimum of five tax years. That means investment gains are tax-free, with no taxes on sales and no taxes when distributing out of the account. This is why many self-directed investors use Roth IRAs for real estate investing.

It works that way because you already paid the taxes on the income that you contributed to the IRA. That’s why they’re often called post-tax contributions, and a Roth IRA is sometimes called a post-tax account (vs a pre-tax contribution or account with a Traditional IRA or 401(k)). Free withdrawals in retirement can come in handy for unexpected expenses.

How to Start a Roth IRA

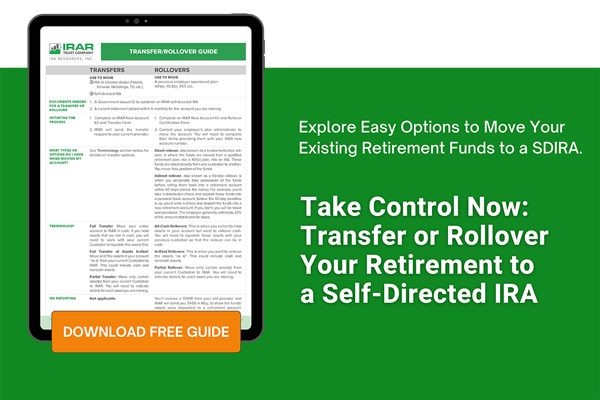

If you have retirement savings in a Traditional IRA or old 401 (k) you can convert these accounts to a self-directed Roth IRA. If you do not have any savings, you can start with a contribution, verify if you qualify for Roth IRA based on your income limit. If you do not qualify for a Roth IRA contribution, Roth conversions are explained above.

The process of establishing the Roth IRA is simple. A financial institution like IRAR can help you. From our website, you can complete a new account application online and then fund the account. Here are your options to fund the self-directed Roth IRA:

- Transfer a Traditional IRA then do a conversion

- If you don't have savings, make the maximum contribution to Roth IRA

- Move an old 401 (k) or Traditional IRA to IRAR, then do a Roth conversion

All the same self-directed IRA rules apply— you can’t engage in prohibited transactions (like investing in life insurance), you can invest in almost all types of investments, but you need a self-directed IRA custodian, just as with any other self-directed IRA. Please see below for details on disqualified persons and entities.

So, what to invest in with your Roth IRA?

Self-directed IRAs unlock a whole world of investment options. From real estate to private equity, you can invest in what you know.

In a Nutshell

Though most with individual retirement accounts end up with a Traditional IRA by default, the key takeaway is that’s not your only option for alternative investments. The Roth IRA is a strong contender with a lot of benefits, but there are restrictions investors should take into consideration.

If you think this account may be the right choice for your retirement strategy, get investment advice from a financial advisor familiar with self-directed IRAs. As with any other truly self-directed retirement account, the investment decisions are always yours to make. Explore the possibilities!

Whether you are interested in rental properties, private stock, or any other type of alternative asset, IRAR Trust Company can help. IRAR is here to answer any questions you or your advisor may have about incorporating a Roth IRA into your investment and retirement strategy.

Self-Directed Roth IRA FAQs

What is a Roth IRA?

A Roth IRA is an individual retirement account (IRA) that allows you to make after-tax contributions, while still letting your money grow tax-free. This means that your contributions are not tax-deductible, but when you make withdrawals in retirement, you may not have to pay taxes.

How do you open a Roth IRA?

To Roth IRA you need to complete a new account application online and provide a form of government-issued identification; ID, driver's license, or passport. Almost anyone with earned income can open a Roth. However, there are income restrictions for contributions to a Roth IRA—find out if you can contribute if that is your goal.

When can you withdraw from a Roth IRA?

Your annual cash contributions can be distributed penalty-free, no matter your age or reason at any time. However, you can’t withdraw any of the gains from investments or contributions until you are of retirement age, 59 1/2, or meet special conditions.

What is the Roth IRA contribution deadline?

The Roth IRA contribution deadline is April 15, 2025. All IRA contribution deadlines are usually on the tax filing deadline.

How do I start a self-directed Roth IRA?

You can start a Roth IRA at any time by making a contribution. To contribute to a self-directed Roth IRA you must meet the income requirements as outlined by the IRS. If you have an account that you want to convert to a Roth but are over the income limit, you may still be able to do that and invest those Roth funds—but won’t be allowed to contribute to the Roth.

Comments (2)