The Solo 401(k) Auto-Enrollment Credit You Shouldn't Overlook

If your current plan doesn’t include the required auto-enrollment feature, you can amend it to qualify. IRAR offers the platform and support to help you do just that.

What Is the Solo 401(k) Auto-Enrollment Credit?

This IRS tax credit allows you to claim $500 annually for three consecutive years if your Solo 401(k) includes an Eligible Automatic Contribution Arrangement (EACA). Unlike a tax deduction, which reduces taxable income, a tax credit directly reduces your tax liability, providing more impactful savings.

Advantages

- Up to $1,500 in Tax Credit: Claim $500 per year for three years.

- Dollar-for-Dollar Tax Cut: More impactful than a deduction.

- Promotes Consistent Saving: Auto-enrollment encourages regular contributions for continuous retirement savings growth and the option to opt out if you choose.

Eligibility Requirements:

- You must have a Solo 401(k) or one-participant 401(k) plan.

- The plan must include an auto-enrollment feature (EACA) and you must participate in the feature.

Note: Solo 401(k)s are typically for self-employed individuals without employees, making this credit favorable for the self-employed.

How to Update Your Plan to Qualify

If your current Solo 401(k) lacks auto-enrollment, you don’t need to start over. You can amend your existing plan.

IRAR Trust Company offers a flexible platform that supports auto-enrollment and helps ensure compliance with IRS rules. With IRAR, your plan will include:

- Optional Auto-Enrollment

- Maintain IRS compliance with proper bookkeeping documentation.

- Access diverse investment options, such as alternative assets.

If your current provider's plan does not qualify, IRAR can assist in updating your plan, without needing to roll over assets or pay high fees to modify your plan.

How to Claim Your Credit

- Ensure Auto-Enrollment is Setup: Confirm your Solo 401(k) includes an EACA.

- Complete and include IRS Form 8881: Submit form 8881 with your tax return to determine the credit.

- Claim the $500 Credit on IRS Form 3800 Part III Line 1dd

- Amend Your Plan if Needed: Work with IRAR to add auto-enrollment if it’s not currently included.

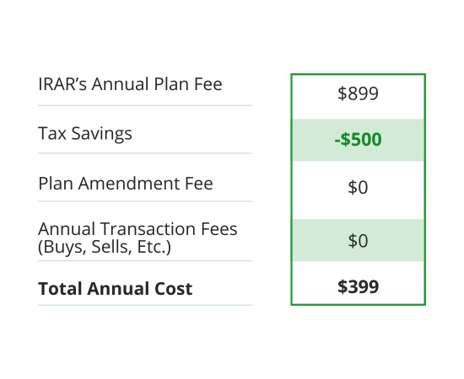

Example of Cost and Savings

Sarah, a self-employed consultant, revised her Solo 401(k) plan to include auto-enrollment in 2025 by moving her plan to IRAR. She claims the $500 credit each year on her taxes, through 2027, saving a total of $1,500. This offsets administrative costs and helps simplify her retirement planning.

Why Now?

The SECURE 2.0 Act mandates auto-enrollment for 401(k) plans starting in 2025. By adopting the IRAR's Solo 401(k) platform, you will automatically qualify for the Tax Credit as well as sign up for a comprehensive 401(k) recordkeeping platform not offered by most providers.

By taking action early, you can maximize tax savings and ensure your plan remains aligned with evolving regulations.

What You Can Do

- Review Your Current Plan: Check your Solo 401(k) to see if it includes auto-enrollment.

- Revise if Necessary: Work with a custodian like IRAR to update your plan.

- File IRS Form 8881 and IRS Form 3800 with your tax return: Don’t miss your opportunity to claim the credit.

Want to learn more or amend your plan? Visit IRAR’s Solo 401(k) platform to explore your options.

Comments (0)