IRA Transfers: A Step-By-Step Guide

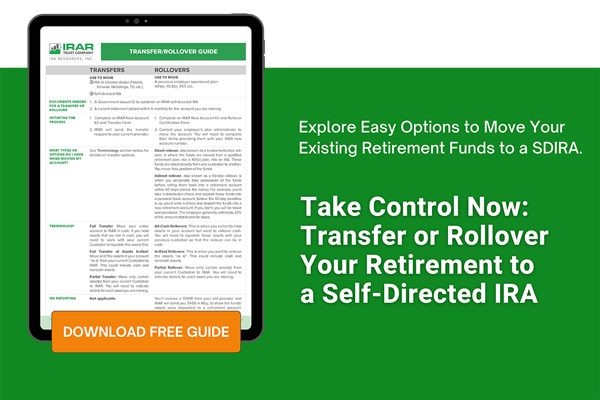

It’s time— you’ve decided to open a self-directed IRA. You can almost picture the financial freedom and the retirement of your dreams. But to get started, you’ve got to make use of your old retirement account. How do you even begin? One of the most common ways to move your retirement account is known as a transfer. Not sure what that means for your retirement fund? Let us explain.

IRA Transfers: What Are They?

A transfer is where your retirement funds are moved directly from one custodian to another. You don’t see the money at all— it goes directly from your old plan to your new plan. This isn’t a taxable event and it isn’t reported to the IRS (unlike a rollover), so there’s no need to think about taxes. You can transfer your account as many times as you’d like, there is no limit on number of transfers per year. A rollover, by contrast, is reported to the IRS and limited to once every 12 months.

The one thing to keep in mind when transferring retirement plans: there are restrictions on which plans can transfer into what account-type. For example, Roth IRAs can only transfer into other Roth IRAs— so make sure you’ve opened the right type of account before transferring your funds. If you’d like more details on what types of plans can transfer into what types of accounts, or have any other questions, you can find more resources at IRA transfers & 401K rollovers.

At IRAR, we simplify retirement every step of the way. Have questions? Connect with our team today and get the clarity you need.

Step-By-Step: Transfer to a Self-Directed IRA

To transfer your account to IRAR, you’ll first need to open an account. You’d do this by completing and submitting an account online. Here's what we need:

- Open an account online

- Complete a Transfer Form

- Provide us a copy of your most recent account statement from your current custodian

There is a $30 fee to accept funds via wire, otherwise there are no charges for processing a transfer request. The paperwork is the same whether you are transferring cash, other assets, or both. Once we have all the required paperwork, we’ll send the request to your current custodian. Please check with them to inquire if they accept fax or email copies of transfer requests before submitting.

Once we receive your completed Transfer Form, we will submit it to your current custodian and notify you of the transaction status. Sometimes, there may be a hold up with your previous custodian— they will require that you communicate directly with them. If this is the case, it is your responsibility to follow up to assure everything is processing smoothly— we cannot do this for you. But don’t worry, we’ll keep you updated. If your custodian requires direct communication, we’ll let you know right away so you can follow up. You’ll also receive an email from us if we haven’t heard back from them and your transfer is taking longer than expected. No matter what, we’ll always keep you in the loop.

All-Cash Transfer Requests

If your account only holds cash, you’re done! Submit the completed forms with a recent statement to IRAR. Now all you’re waiting for is the funds to arrive.

If you hold assets in your current account and intend to transfer as cash, you will need to liquidate them before submitting your transfer request— otherwise your current custodian will reject the transfer and you will have to start the process again. This includes Brokerage IRAs, which will also need to be liquidated before transferring.

In-Kind Transfer Requests

If transferring assets in-kind from your previous custodian, your assets will need to be reregistered in the name of the new IRA (“IRAR Trust FBO: client name IRA, client account number”). For real estate and similar investments, this means the deed must be reregistered.

Some custodians require a Medallion Signature Guarantee when transferring your account. This is an authorized signature that guarantees securities. It’s used as an assurance from the transferring institution that the signature is genuine, to protect against forgery and fraud. Some providers have started asking for a medallion guarantee on transfers for assets that are not securities, and even cash— though this is not required and not technically how the medallion signature is intended to be used. IRAR doesn’t require these signatures, except on securities. A note to remember: A Notary Public is not the same as a Medallion Signature Guarantee and would not be an acceptable substitute.

After completing and submitting the paperwork, we wait for your current custodian to send the assets our way, where they will be deposited in your new IRAR account.

That’s it— once your funds arrive, you’re ready to invest!

Transferring your retirement account is the most common way to move your IRA to another IRA. It might sound like it’s going to be complicated, but it’s not— especially at IRAR. We keep the process simple.

The process has a few steps, but with our handy guide — you’ve got this. And if questions come up, our team is always here to help—just reach out anytime. Ready to take the next step? Start your transfer today and put your retirement into assets you can control.

Frequently Asked Questions

How long does an IRA transfer take?

At IRAR, most IRA transfers take 2–4 weeks to complete, depending on your current custodian’s processing times. Some custodians respond quickly, while others may require additional paperwork, which can extend the timeline. IRAR submits transfer requests promptly to minimize delays.

Does an IRA transfer incur taxes?

No. An IRA transfer is a trustee-to-trustee transfer between custodians. Because the funds never pass through your hands, it is not taxable and does not create a reportable distribution.

How to transfer money from one IRA to another?

With IRAR, you simply complete our Transfer Form, and we’ll send it to your current custodian. Once they release the funds, we deposit them directly into your new IRAR self-directed account. You do not need to handle the money yourself, avoiding taxes.

Are there fees for transferring an IRA?

IRAR does not charge a transaction fee for incoming transfers. If your transfer is sent via bank wire, there is a $30 fee. However, some custodians charge an outgoing transfer fee when you move funds away from them. It’s best to check with your current custodian.

Do I have to pay taxes on an IRA transfer?

No. A direct IRA transfer between custodians is tax-free and does not count toward your annual contribution limits. Taxes and penalties only apply if you take a distribution and keep the funds yourself instead of transferring them directly from your current custodian to IRAR.

How often can I transfer an IRA? Is there a limit to how many IRA transfers I can make per year?

You can make unlimited IRA transfers per year. The once-per-year rule applies only to IRA rollovers (when you take possession of funds), not direct custodian-to-custodian transfers.

Do I need to liquidate assets before transferring an IRA?

It depends on your investment strategy and your new custodian’s rules. If you plan to invest in alternative assets like real estate, liquidating to cash before transferring can make funds available faster. However, you can also transfer assets in kind if your new custodian permits it. IRAR accepts both cash and alternative assets in kind transfers.

Will transferring my IRA delay my investments?

It depends on your current custodian. Funds are not available for investing until your custodian releases them and IRAR receives them. To minimize downtime, IRAR processes transfer requests quickly and keeps you updated throughout the process. However, the timing ultimately depends on how fast your current custodian sends the funds.

What happens if my custodian rejects an IRA transfer?

If your custodian rejects the transfer, IRAR will notify you right away. Rejections usually happen if paperwork is incomplete or if your custodian has specific requirements. We’ll work with you to correct the issue and resubmit.

Can I transfer part of my IRA instead of the whole account?

Yes. You can transfer all or just a portion of your IRA. On the IRAR Transfer Form, you can specify a dollar amount, percentage, or specific assets to transfer.

Do I lose interest or dividends during an IRA transfer?

No. Any dividends or interest accrued before your custodian processes the transfer should be included in the transfer. In some cases, residual dividends may arrive later in a second transfer. The custodian is responsible for sending these funds to IRAR for deposit into your account.

Comments (4)