How To Re-Register Your Real Estate IRA Assets

Need to move your real estate IRA to a better custodian, without liquidating the property? You can at any time. But what many real estate IRA investors don’t know is that once your asset has moved to your new account, the process isn’t done. You have to re-register the deed to the property. If you don’t follow through, there can be obnoxious (and expensive) complications down the line.

But at what point in the process do you need to step in, and where do you go to get done whatever it is you need to get done? Never fear— at IRAR, we’re here to help you cover all the details.

Once You’ve Opened Your Account At IRAR

If you’re reading this, let’s assume you’ve already submitted your completed transfer forms to move your real estate assets to IRAR. If not, you’ll need to do that. More about the IRA transfer process here. After you submit your paperwork, we’ll send your transfer request to your current custodian— and then we wait for them to mail us official notice of the change in ownership.

- NOTE ABOUT PROCESSING TIMES: Once we submit the transfer request, timing is wholly dependent on your previous custodian. The average transfer takes about two weeks— some take as little as two days, while others can sit pending for a long, long time. If you want to speed up this process, it helps to call your current custodian and inquire. There may be something only you can handle holding up the transaction.

Once your previous custodian sends us the change of ownership notice and transfer paperwork, we then book your asset in our system. If you didn’t know any better, you could think your real estate IRA is all set and ready to go at this point— but no.

This is where you come in— though the asset is booked in our system, it’s not filed with the county. have to do that yourself, or your IRA can pay a third party to do that.

Related Download: How to Transfer a Self-Directed IRA [GUIDE]

Re-Registering Your Real Estate Asset

Since your asset hasn’t been recorded with the county, as far as they know your old IRA still owns it. This process of changing ownership is known as re-registering, or re-titling, a property. For purposes of IRA transfers, this is what you need:

Vesting for Your New Deed

If your deed hasn’t been re-registered, your property is currently registered in the name of your old IRA, and it needs to be updated on any new documents. At IRAR, we need the deed titled as follows:

IRAR Trust FBO Client Name and Account Number

Example: IRAR Trust FBO John Doe #123456

When creating a new deed (or having a new deed created), be sure the asset is vested appropriately, or it will need to be amended. Include IRAR’s mailing address on the documents as well (you can find this on our website) so we can get all appropriate notices promptly.

Quitclaim Deed vs Warranty Deed

Investors typically re-register their real estate through a quitclaim deed (instead of a warranty deed) since your IRA is the previous owner, though either type is acceptable. Warranty deeds must be witnessed and notarized to be considered valid. Some counties require a specific type or have other requirements, so be sure to verify before creating or filing any documents.

Creating the Deed

IRAR does not create or provide re-registered deeds. This is something you’ll have to do yourself. There are many resources online to create your own quitclaim or warranty deed, or you can find a local title company to do this for you.

If you choose to create a deed yourself, a quick search can find a bunch of sites that will help you generate what you need. If you have any questions, you can pull the information for your new deed from the existing deed.

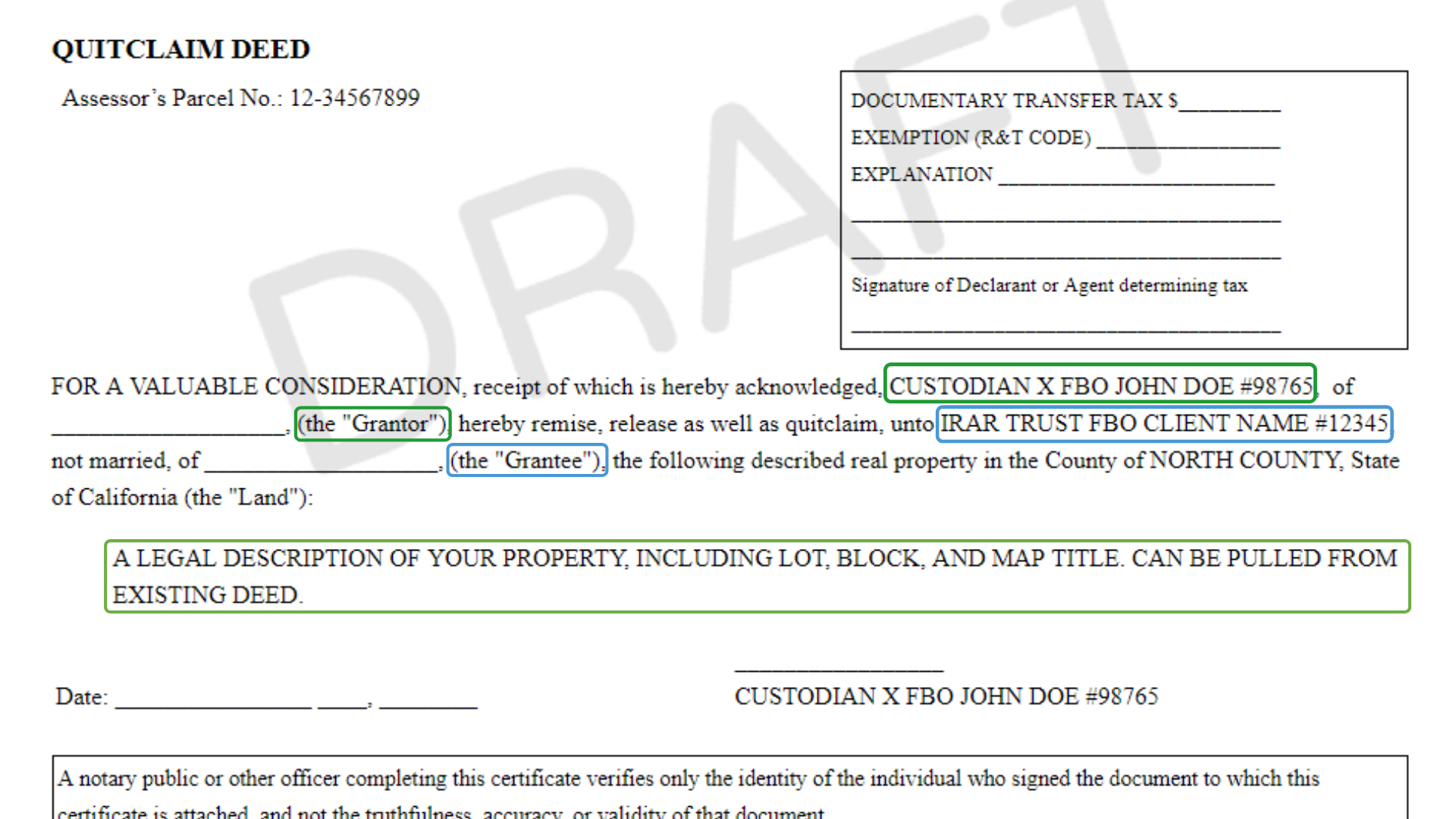

Under “grantor” you’ll put the name of your old IRA “CUSTODIAN X FBO John Doe #98765”(example 1a), with the name of your new IRA under “grantee” (“IRAR Trust FBO Joh Doe #123456”(example 2a). You’ll need to provide a legal description of the property, including address and map title(example 3a), which you can also pull from your existing deed.

EXAMPLE 1: A QUITCLAIM DEED

1a: previous custodian information, 2a: new IRAR account information, 3a: legal description of property

Or if you’d like, you can find a local realtor, broker, lawyer, or title company to handle this for you. This can be convenient if your investment is far away, as some of these companies will file the deed at the county recorder’s office for you.

Your Old Custodian Releases Your Asset

Your old custodian will have to sign this newly created deed (“releasing” it so that IRAR can accept it), or the county won’t file and record it. You can submit this with your initial transfer form, if you have it completed.

Filing the Recorded Deed with the County

You’ll then need to record and file the deed with the county. Some counties allow this to be done online, and some do this by mail, but many require in-person filing. Take that into account when making plans to re-register your deed. There’s usually a small fee for this.

There may also be additional forms, fees, or processes required, depending on the county, but these costs and requirements can vary. It’s a good idea to confirm requirements with your county, so you can make sure you’re doing everything as required.

Additional Forms

Some states and counties require additional forms, as mentioned above, so be sure to verify the specific requirements for your situation. For example, in California you are also required to submit a Preliminary Change of Ownership (PCOR) form during this process.

After the deed has been rerecorded with the county, please send a copy of the deed to IRAR for our records. The address on record for mailings should be IRAR’s mailing address.

- DON’T FORGET: Be sure to update the name on all bills and agreements, like insurance and utility payments, or your tenant’s rental contract, into the name of your new IRA.

Relevant: It's So Easy— Transfer Your Self Directed IRA To A Better Custodian

What Happens if I Don’t Do This?

If you don’t file the deed with the county, your old IRA (which may not even exist anymore) is still the owner of the property on record— this can cause complications when it comes to paying taxes, renting the property, getting insurance or a loan. You want the property to be in the name of the correct owner— your current self directed IRA— to prevent any headaches down the road.

Conclusion

It’s a quick process to finalize your real estate IRA transfer— and if you don’t, you could be causing yourself some annoyance down the line. Similar and relatively simple, as long as you anticipate and prepare for the process. As long as you make sure to property vest your asset in the name of your new IRA, and property file the quitclaim or warranty deed, your property will be set for whatever you have planned while investing for your future retirement. And if you have any questions, concerns, or comments— please reach out to an IRAR representative, we’d be happy to help in any way we can.

Comments (2)