Fee Comparisons: How Much Will Your Self-Directed IRA Cost You?

Convenient investing, lower investment fees, and the ability to choose exactly what you want to invest in are all reasons investors are opening a self-directed IRA (SDIRA) account.

In as little as 15 minutes, you can begin to financially plan for retirement using an SDIRA. With ample investment choices and tax benefits, your SDIRA can complement or act as an alternative to a 401(k), easily tripling or quadrupling your investment funds.

But how much does an SDIRA cost to open and maintain? What are the self-directed IRA fees when it comes to making transactions? Let’s take a further look into your options.

What is a Self-Directed IRA?

SDIRAs can provide investors access to higher return opportunities on their investments and more diversification compared to traditional IRAs. If you can stomach a higher risk threshold, real estate, businesses, precious metals, foreign currencies, private loans, private equity, cryptocurrencies, and commodities. These are investment opportunities allowed beyond your usual stocks, bonds, ETFs, and mutual funds found in a traditional IRA.

However, because you hold the reins when it comes to an SDIRA, you’ll need to be more hands-on when making financial investment decisions. Part of that decision process involves setting up and managing your own account. One of the first steps you’ll want to take is to find out the costs or fees associated with your SDIRA account.

How Much Do Self-Directed IRAs cost?

SDIRA fees vary across IRA custodians, providers, and promoters. Which SDIRA custodian you use, investment type, and services used can also impact how much you’ll pay in fees. You’ll find that most SDIRA custodians typically charge three types of fees: a setup fee, an annual fee, and a transaction fee. In total, these fees can cost from $0 to around $3,000 annually— sometimes even more.

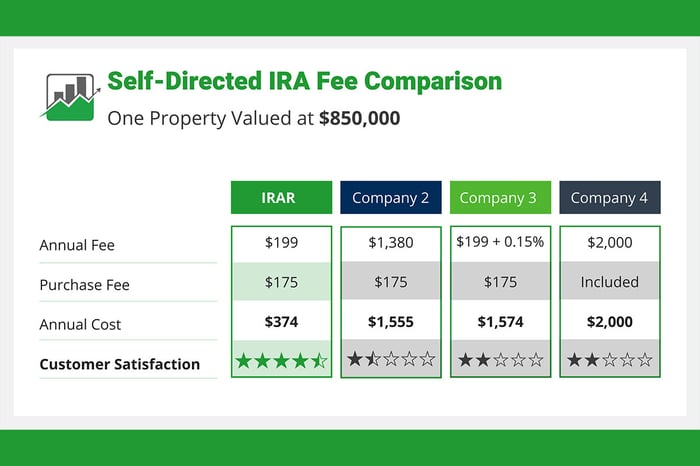

According to investopedia some of the best self-directed IRA custodian platforms have hefty high fees and average to poor service. We did our own research for self-directed IRA custodian fees.

We’ve compiled a list of some of these IRA providers and the fees they charge focusing on annual fees, transaction fees, and other service-related fees. When comparing and conducting due diligence the best, largest self-directed IRA custodians for alternative investments according to Investopedia. In our research, we discovered that most were not IRA custodians. This is why it's important to know the difference between these financial institutions.

Self-Directed IRA Cost Comparison

No-fee IRA accounts are few and in between. Be careful about providers that advertise claiming no upfront fees or all inclusive fees only to hit you with fees to compensate for them later. Also, make sure that you do thorough research on lawsuits and SEC filings.

One particular area you must research when comparing custodians are soft skills. What is the overall employee sentiment for the company, CEO, and management— it's a reflection of client services. Unhappy employees will not provide good service.

Self-Directed IRA Fee Comparison Tools and Tips

Make sure to take advantage of free resources to compare self directed IRA real estate fees— most investors seek to invest in real estate.

If you have an existing IRA invested in stocks and ETFs, a retirement account on a trading platform, or some kind of brokerage account, you may be able to be self-direct it. Make sure to compare the fees for your existing account with new account. For example, trading fee, account minimum fee, fee based services, etc.

Before opening an IRA, make sure you know the types of investments available for your IRA to invest in. All investment decisions and retirement planning are your responsibility. That means that there is no automated investing in self-directed IRAs— for that, you would need a trust company like Charles Schwab. Self-directed IRAs are for individuals that wish to invest in non-traditional assets like, real estate and private equity, usually not allowed at these firms.

How Can IRAR Help?

If you have additional questions about IRA account fees, like “Are self-direct IRA custodial fees tax deductible?” IRA Resources (IRAR Trust Company) has spent almost 30 years helping investors at all levels answering questions like these. Our fees are some of the lowest fees in the industry. With an annual fee of $199 and low transaction fees, our white-glove client services are unmatched.

One of our experts would be glad to go over the fees you might expect when it comes to your SDIRA or address any other concerns you may have. Reach out to us today to start planning for your future financial freedom.

Comments (0)