5 Reasons Syndicated Multifamily Real Estate Investments are Goldmines

We all know that investing through your Self-Directed IRA (SDIRA) can provide a level of financial control not often available through a traditional retirement account. The idea of Investing in non-public investment vehicles holds great appeal, allowing the account holder to direct how their IRA funds are invested without being confined to traditional markets.

One of the most common investments is real estate due to the stability, appreciation and cashflow it often provides as well as being an excellent hedge against inflation. These benefits are particularly evident in multifamily assets. However, with those benefits, comes significant time commitment. The time and effort required to research, finance, purchase combined with the ongoing management of multifamily real estate is significant. This can often dissuade individuals from including this asset class as part of their retirement plan. There is now a viable solution for those missing out….Real Estate Syndication Partnerships!

Let’s cover the basics.

What is Multifamily Real Estate Syndication?

Real estate investing is not a one-person operation. Making and maintaining a real estate investment takes time and effort. However, if real estate isn't your primary area of expertise, handling everything on your own will quickly become stressful.

That's where multifamily syndication comes into play since it allows you to increase your real estate assets without becoming a traditional landlord or dealing with time-consuming legal requirements.

The term "multifamily syndication" refers to a real estate transaction where numerous investors pool their finances to purchase a property. A sponsor is in charge of the acquisition process, organizing the transaction and funds, and overseeing the investment once finalized.

This sponsor is the general partner (GP). Passive investors or limited partners (LPs) contribute the majority of the capital in return for equity in real estate. LPs or investors enjoy a relatively hands-free investment while the GP operates the asset. In return for their work, the GP is rewarded with additional equity or cash flow once a return hurdle is met which is referred to as a Preferred Return.

For Example: A typical syndication structure will have the GPs contributing 10% of the required equity and the LPs contributing the remaining 90%. The first 1$ of cashflow is split accordingly with 90 cents going to the LPs and 10 cents going to the GP. This allocation continues up until the Preferred Return hurdle is achieved. Although they will vary, a typical Preferred Return hurdle is 8%. That means that until the LPs have achieved a cumulative 8% annual return on their investment, the proceeds from the investment are split according to the 90/10 contribution ratio. Once investors have realized an 8% annual return, the next 1$ is split 75/25. This structure incentivizes the GP to optimize the performance of the investment as they don’t reap any outsized benefits until the preferred return hurdle is met.

Any real estate investment type can be used in a syndication deal, although multifamily is presently the most popular. Multifamily investing is popular among real estate investors because it frequently delivers consistent income and is considered one of the safer types of real estate investments. After all, people will always need a place to live.

5 benefits of owning multifamily real estate in an IRA?

1- Lack of correlation and unstable traditional markets:

As we saw in 2020, the Covid 19 pandemic caused a collapse of most of the economy. Currently, we are experiencing yet another downturn as red-hot inflation and slowing economic growth strain the stock markets and make bond investing a losing bet with an effectively negative yield. The economic impact of the pandemic continues to be felt worldwide, and it is understandable that investors were (or may still be) skittish about the market. While the stock market is volatile and unpredictable, multifamily real estate investments have produced consistently growing cashflow and have appreciated in value.

2- Sustained and generally predictable cash flow:

We are familiar with the concept of purchasing real estate and renting it out. The traditional “landlord” model of buying a house and renting it out to tenants has long been used as a method to create an additional stream of income. But what happens when the tenant moves out and you are left with a vacancy. The time it takes to make necessary repairs, clean the unit, market and show to prospective renters and then screening applicants coordinating a move in, can often take well over a month. To put this in perspective, one month of vacancy of a rental property equates to 8% less annual rental income. During this vacancy, your mortgage is still due, and utilities still need to be paid. So not only does vacancy impact cashflow, but it can often cause the owner to come out of pocket.

Apartment buildings on the other hand spread the vacancy risk. With multifamily housing, the general rule of thumb is to expect 5% vacancy. Sponsors can anticipate this and bake it into your financial budget. This ability allows the sponsor to project and deliver consistent cash flow to the investors throughout the life of the investment.

3- Locally focused research:

When investing in real estate of any kind, it is important to have a deep understanding of the local market. Although you may have a good understanding and grasp of the area where you live, most people do not have access to the data or time to research apartment buildings in markets on the other side of country which may have significant potential. That task falls to the sponsor. Syndication sponsors have teams of analysts that research market conditions such as average incomes, population inflows, future supply, local legislation and even the preference of renters in the area. This data allows the sponsor to increase the reliability of their financial projections and invest in markets that will ultimately lead to the best return.

4- Historical increase in home prices provides inflation hedge :

It is no mystery that the housing market is crazy right now. Single family home prices have grown at a record pace over the last two years. The increase in pricing and now increase in interest rates have forced many would-be buyers to abandon, or temporarily sideline their plans to buy a home. What do people do when they can’t afford to buy? They rent! More specifically, they rent apartments. Many Americans have opted to downsize and live in an apartment in an effort to save up money to purchase the home of their dreams. “There has been a priority shift for first time home buyers” according to Elliott Burrell, Director of Acquisitions at Interwest Capital Group. “We have found that their allocation of discretionary income is geared towards life experiences such as travel and they are putting off their first home purchase until later in life.” This trend has further increased demand for apartments. Over the past 50 years home prices have consistently moved higher, and logically, apartments rents have moved in lockstep.

Reference: Median Sales Price of Houses Sold for the United States. www.investopedia.com

Reference: Median Sales Price of Houses Sold for the United States. www.investopedia.com

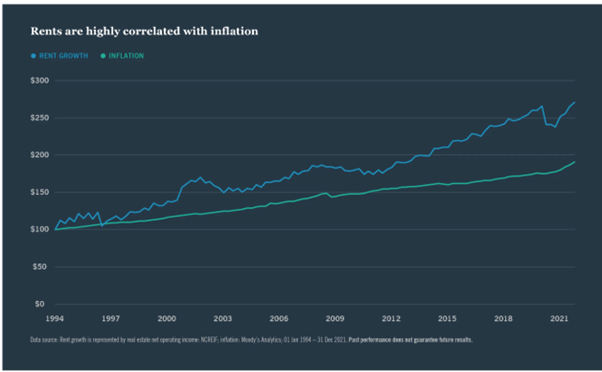

Additionally, the red-hot inflation brought on by increased consumer demand coupled with supply chain disruption has made investing more difficult. Bond yields, when adjusted for inflation, offer negative yields. Fixed income investing has become more difficult than ever. Once again, multifamily family syndications present a solution. Along with dependable, cashflow, the underlying investment (the property itself) increases in value as inflation increases due to a correlation of rents and inflation. By steadily increasing in value, investors can have peace of mind that their hard-earned nest egg is not eroding in the face of inflation.

5- Responsible leverage multiplies your return:

Multifamily real estate investments are rarely purchased without debt. The use of different financial tools or borrowed resources (e.g., debt) to boost the possible return on investment is known as leverage.

For example, a conservative loan to value (LTV) of 40% down buys you 100% of the asset. If we use $10 million as our purchase price, the buyer in the scenario would put down $4 million and borrow the remining $6 million. Suppose the property appreciates by 20% over the course of ownership and you sell it for $12 million. After paying off the debt, the seller is left with their initial $4 million plus the $2 million in appreciation. The investor has now profited $2 million on their $4 million dollar investment or 50%, all the while enjoying regular cashflow. This is the beauty of leverage.

Conclusion:

After a lifetime of working and saving, retirement is the light at the end of the tunnel. Most of us envision it as a time of rest when we enjoy the fruits of our labors. We expect a steady source of income without the need to go to work each day. Multifamily real estate syndicates can be an integral piece of than plan while bringing the investor joy, knowing that their investment has an address, includes land, and provides homes for individuals and families to enjoy.

For further questions regarding investing in real estate syndications, please feel free to reach out to me, Peter Richter, at Interwest Capital by emailing Peter@interwestcapital.com.

By Peter Richter

Director Of Investor Relations and Capital Markers

Interwest Capital Group

interwestcapital.com | Peter@interwestcapital.com

Disclaimer: IRA Resources (IRAR) does not affiliate itself or make any recommendations to any person or entity associated with investments of any type (including financial representatives, investment promoters or companies, or employees, agents or representatives associated with these firms). IRA Resources (IRAR) is not responsible for and is not bound by any statements, representations, warranties or agreements made by any such person or entity and does not provide any recommendation on the quality, profitability, or reputability of any investment, individual or company.

Comments (0)